Gold vs Dollar

GOLD INVERTED RELATIONSHIP WITH THE U.S DOLLAR.

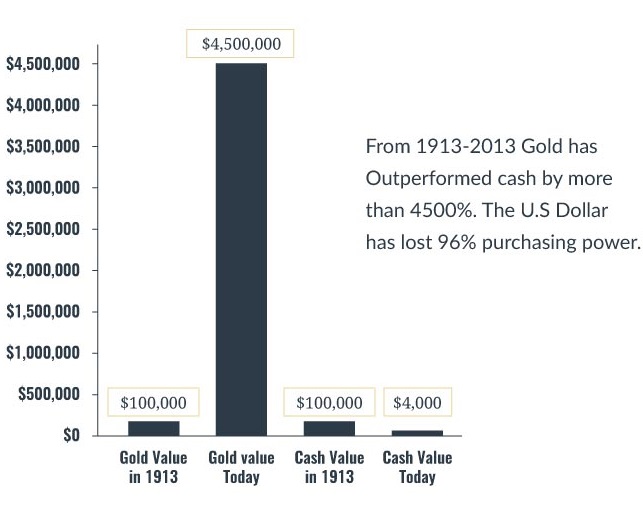

This shows a clear perspective and visual on Gold’s inverted relationship with the U.S dollar. Fiat currencies generally devalue overtime due to economic pressures that cause inflation -- while assets with intrinsic value such as gold do an outstanding job of preserving value over the long-term.

This chart shows how an amount of gold worth $100,000 in 1913, when the Federal Reserve was created, is now worth $4.5 Million today. While $100,000 USD held for the same period is now only worth $4,000! The sinking dollar has lost 96% of its value since 1913 and is quickly losing World Central Bank confidence.1

Since the Federal Reserve started printing the U.S Dollar, it has done nothing but decline in value over the long-term. If your family saved $100,000 for you in 1913, and you tried to spend it in today’s economy -- it would not carry you very far. Let’s look at what things cost in 1913 to help put this in real terms.

1. https://medium.com/swlh/how-much-does-your-cash-cost-1110a7437abb

How Much Things Cost in 1913

Average cost of a new house: $6,500.00

Average wages per year: $1,600.00

A gallon of gas: 10 cents

Average cost for house rent: $17.00/mo.

A loaf of bread: 6 cents

Average Price of new car: $600.00

Nicely tailored suit $25.00

How Much Things Cost in 2013

Average cost of new house: $250,000.00

Average wages per year: $39,000.00

A gallon of gas: $3.70-$4.30

Average cost for house rent: $800.00/mo.

A loaf of bread: $2.50.

Average price of a new car: $28,400.

Nicely tailored suit: $1000-$2000

If you factor in expenses such as energy costs, insurance, tuition, and medical costs, it’s easy to see that $100,000 today does not buy very much in today’s economy, although it would have bought plenty in 1913. For example, you could buy 15 new homes in 1913, but today you could not even buy 1! In the last decade the U.S. Dollar has taken a nosedive at an alarming rate and holding on to a thin tread. Let’s say you deposited or put away $100,000 in 2000. Today it is only worth about $74,000.

If you purchased $100,000 of gold in 2000, today it is worth over $530,000. Since 2000, the dollar has lost over 27% of its purchasing power, while gold gained an astonishing 530%.