Gold Reserve Fiat Currencies

FACING CHALLANGES

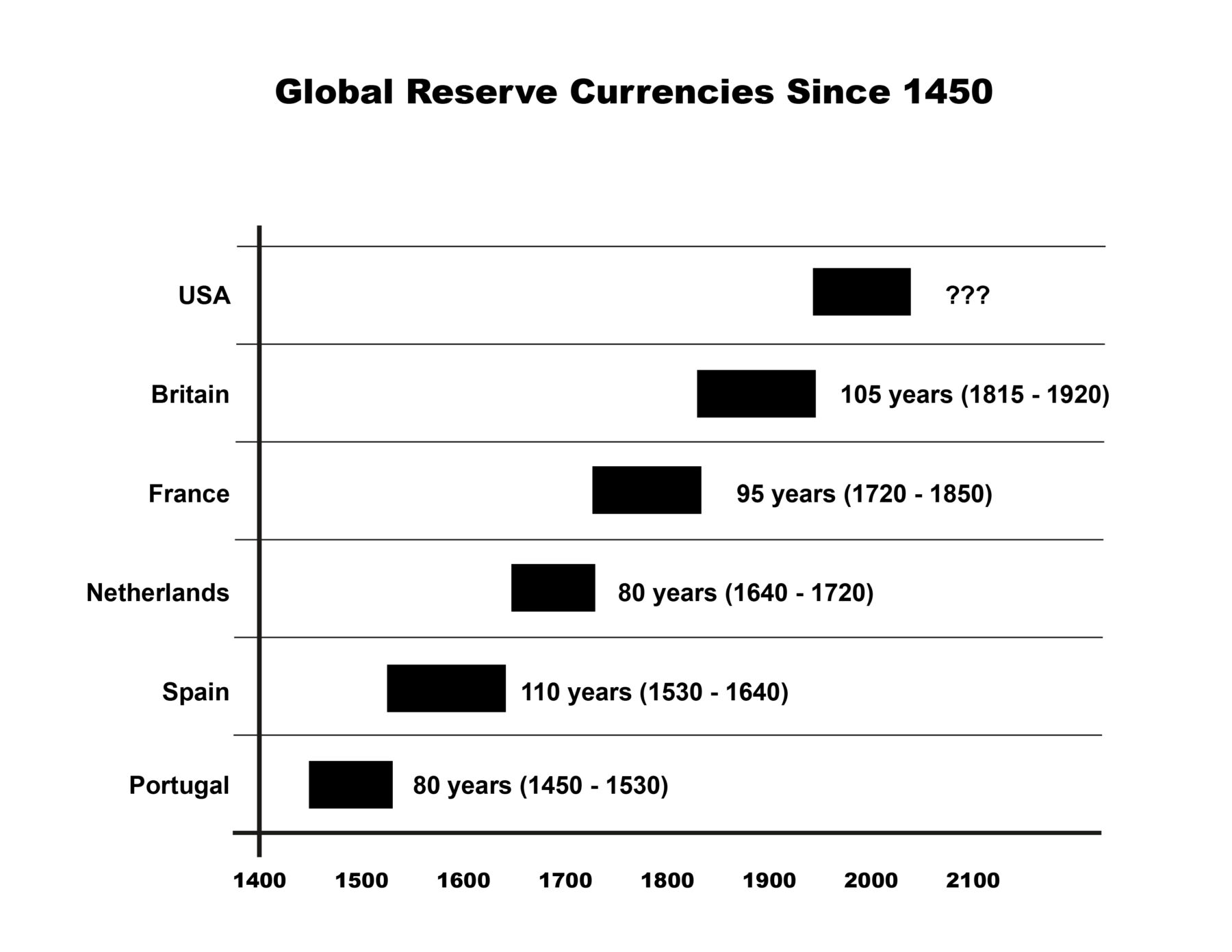

It comes as no surprise that the U.S dollar is facing challenges. Global reserve currencies have historically lasted in cycles of about 100 years as seen on the currency chart. Fiat currencies have historically recorded an average life span of 27 yrs. The USD has been serving as a global reserve currency for over 90 years, 40 of which as a fiat global reserve currency. If history repeats itself, then the USD is fast approaching its “use by date”. It is little wonder that many are preparing not just for the inevitable loss of the dollar's reserve status but also the demise of the currency itself.

Central Banks across the world are purchasing heavy amounts of gold.1 China and India, the world's two largest buyers of physical gold, are seeing increased demand .2 This comes as a bit of a surprise since gold has historically shown a low correlation with most asset classes and global financial markets have been on a prolonged bull run. Central Banks, however, continue to buy gold at record levels.3

Central and Eastern European Central banks, in particular, have dramatically increased their gold reserves. Countries like Hungary, Poland and Serbia have added hundreds of tonnes to their gold holdings just over the past few years. In the single month of March in 2021, Hungary tripled its gold reserves.4

According to the World Gold Council, the National Bank of Poland increased its gold holdings by 25.7 tonnes in the second half of 2018, and a further 100 tonnes in the second quarter of 2019, which is the largest global single gold purchase of the last decade.

1. https://www.gold.org/goldhub/gold-focus/2021/06/central-bank-gold-buying-gathers-steam

2. https://www.reuters.com/business/energy/china-india-buying-adds-support-bullish-gold-narrative-russell-2021-05-27/

3. https://www.yahoo.com/now/central-banks-keep-buying-gold-195134503.html

4. https://www.gold.org/goldhub/gold-focus/2021/04/central-and-eastern-european-central-banks-significantly-expand-gold-reserves

“Buy gold and sit on it. That is the key to success.”

– Dr. Franz Pick, Currency Expert and Noted Economist